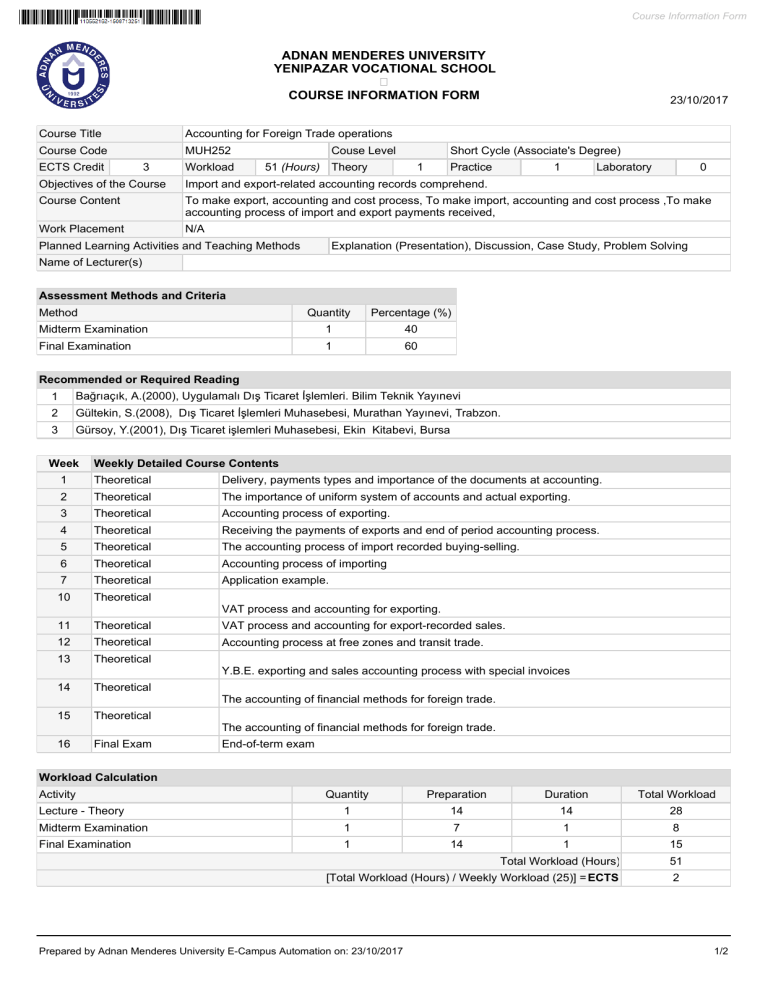

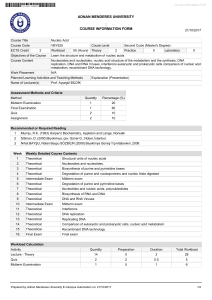

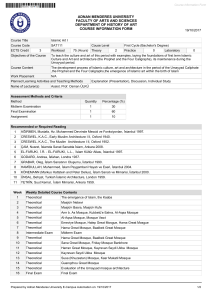

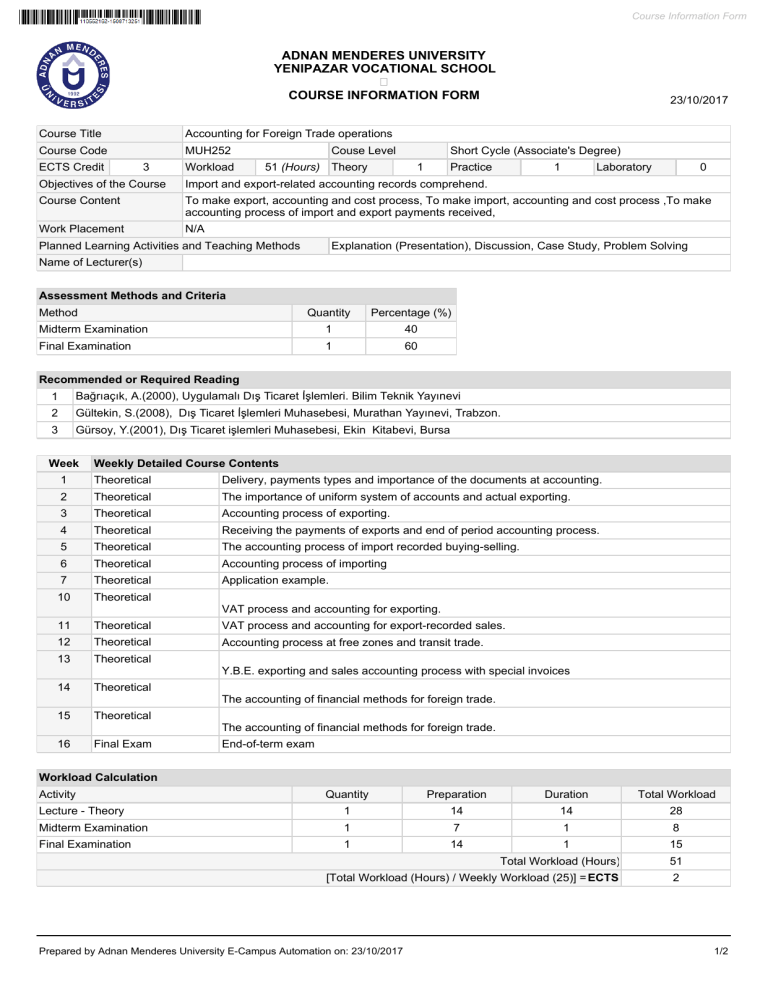

Course Information Form

ADNAN MENDERES UNIVERSITY

YENIPAZAR VOCATIONAL SCHOOL

COURSE INFORMATION FORM

Course Title

Accounting for Foreign Trade operations

Course Code

MUH252

ECTS Credit

3

Workload

Couse Level

51 (Hours)

Theory

23/10/2017

Short Cycle (Associate's Degree)

1

Practice

1

Laboratory

0

Objectives of the Course

Import and export-related accounting records comprehend.

Course Content

To make export, accounting and cost process, To make import, accounting and cost process ,To make

accounting process of import and export payments received,

Work Placement

N/A

Planned Learning Activities and Teaching Methods

Explanation (Presentation), Discussion, Case Study, Problem Solving

Name of Lecturer(s)

Assessment Methods and Criteria

Method

Quantity

Percentage (%)

Midterm Examination

1

40

Final Examination

1

60

Recommended or Required Reading

1

Bağrıaçık, A.(2000), Uygulamalı Dış Ticaret İşlemleri. Bilim Teknik Yayınevi

2

Gültekin, S.(2008), Dış Ticaret İşlemleri Muhasebesi, Murathan Yayınevi, Trabzon.

3

Gürsoy, Y.(2001), Dış Ticaret işlemleri Muhasebesi, Ekin Kitabevi, Bursa

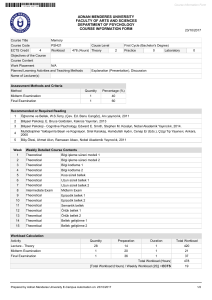

Week

Weekly Detailed Course Contents

1

Theoretical

Delivery, payments types and importance of the documents at accounting.

2

Theoretical

The importance of uniform system of accounts and actual exporting.

3

Theoretical

Accounting process of exporting.

4

Theoretical

Receiving the payments of exports and end of period accounting process.

5

Theoretical

The accounting process of import recorded buying-selling.

6

Theoretical

Accounting process of importing

7

Theoretical

Application example.

10

Theoretical

VAT process and accounting for exporting.

11

Theoretical

VAT process and accounting for export-recorded sales.

12

Theoretical

Accounting process at free zones and transit trade.

13

Theoretical

Y.B.E. exporting and sales accounting process with special invoices

14

Theoretical

The accounting of financial methods for foreign trade.

15

Theoretical

The accounting of financial methods for foreign trade.

16

Final Exam

End-of-term exam

Workload Calculation

Activity

Quantity

Preparation

Duration

Total Workload

Lecture - Theory

1

14

14

28

Midterm Examination

1

7

1

8

Final Examination

1

14

1

15

Total Workload (Hours)

51

[Total Workload (Hours) / Weekly Workload (25)] = ECTS

2

Prepared by Adnan Menderes University E-Campus Automation on: 23/10/2017

1/2

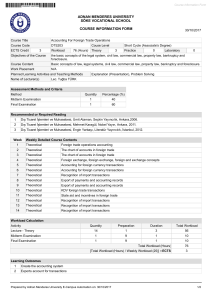

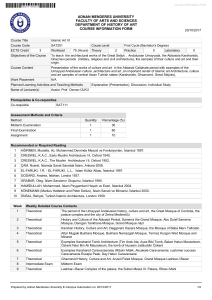

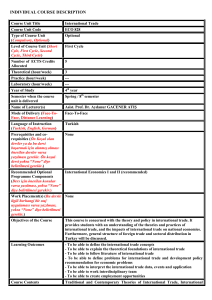

Course Information Form

Learning Outcomes

1

2

3

4

5

6

Programme Outcomes (Accounting and Tax Practises)

1

2

3

4

5

6

7

8

9

10

Contribution of Learning Outcomes to Programme Outcomes 1:Very Low, 2:Low, 3:Medium, 4:High, 5:Very High

L1

L2

L3

L4

L5

L6

P1

2

3

2

3

3

3

P2

3

3

3

3

3

3

P3

2

2

2

2

2

2

P4

2

3

3

3

3

3

P5

4

4

4

4

4

4

P6

2

2

2

2

2

2

P7

4

4

4

4

4

4

P8

3

3

3

3

3

3

Prepared by Adnan Menderes University E-Campus Automation on: 23/10/2017

2/2