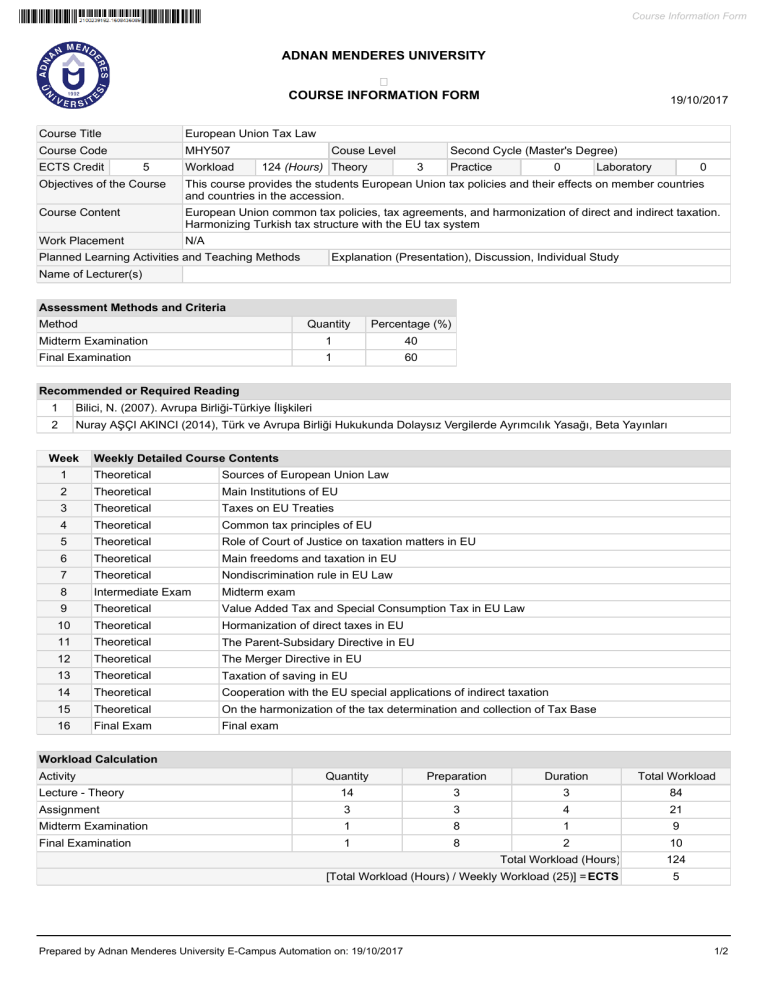

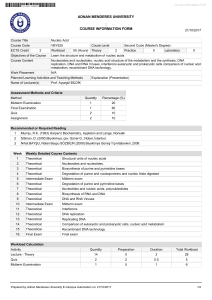

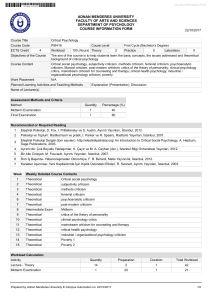

Course Information Form

ADNAN MENDERES UNIVERSITY

COURSE INFORMATION FORM

Course Title

European Union Tax Law

Course Code

MHY507

ECTS Credit

5

Workload

Couse Level

19/10/2017

Second Cycle (Master's Degree)

124 (Hours) Theory

3

Practice

0

Laboratory

0

Objectives of the Course

This course provides the students European Union tax policies and their effects on member countries

and countries in the accession.

Course Content

European Union common tax policies, tax agreements, and harmonization of direct and indirect taxation.

Harmonizing Turkish tax structure with the EU tax system

Work Placement

N/A

Planned Learning Activities and Teaching Methods

Explanation (Presentation), Discussion, Individual Study

Name of Lecturer(s)

Assessment Methods and Criteria

Method

Quantity

Percentage (%)

Midterm Examination

1

40

Final Examination

1

60

Recommended or Required Reading

1

Bilici, N. (2007). Avrupa Birliği-Türkiye İlişkileri

2

Nuray AŞÇI AKINCI (2014), Türk ve Avrupa Birliği Hukukunda Dolaysız Vergilerde Ayrımcılık Yasağı, Beta Yayınları

Week

Weekly Detailed Course Contents

1

Theoretical

Sources of European Union Law

2

Theoretical

Main Institutions of EU

3

Theoretical

Taxes on EU Treaties

4

Theoretical

Common tax principles of EU

5

Theoretical

Role of Court of Justice on taxation matters in EU

6

Theoretical

Main freedoms and taxation in EU

7

Theoretical

Nondiscrimination rule in EU Law

8

Intermediate Exam

Midterm exam

9

Theoretical

Value Added Tax and Special Consumption Tax in EU Law

10

Theoretical

Hormanization of direct taxes in EU

11

Theoretical

The Parent-Subsidary Directive in EU

12

Theoretical

The Merger Directive in EU

13

Theoretical

Taxation of saving in EU

14

Theoretical

Cooperation with the EU special applications of indirect taxation

15

Theoretical

On the harmonization of the tax determination and collection of Tax Base

16

Final Exam

Final exam

Workload Calculation

Activity

Quantity

Preparation

Duration

Total Workload

Lecture - Theory

14

3

3

84

Assignment

3

3

4

21

Midterm Examination

1

8

1

9

Final Examination

1

8

2

Total Workload (Hours)

[Total Workload (Hours) / Weekly Workload (25)] = ECTS

Prepared by Adnan Menderes University E-Campus Automation on: 19/10/2017

10

124

5

1/2

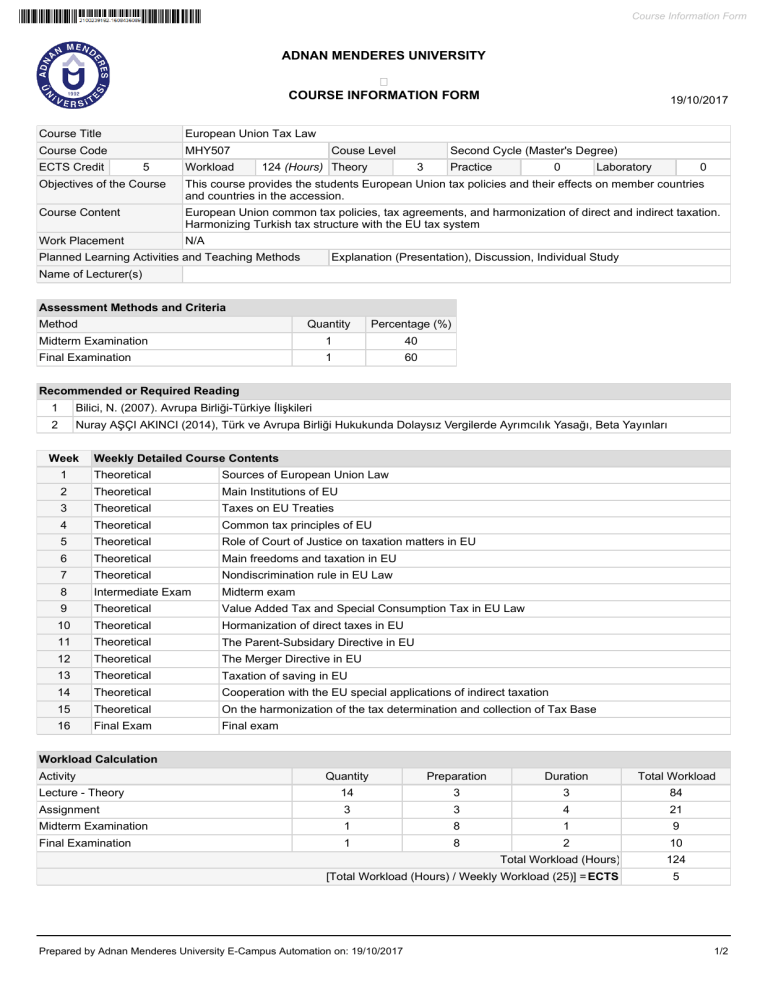

Course Information Form

Learning Outcomes

1

To be able to analyze revenue policy of the European Union

2

To be able to analyze Turkey's income policy

3

To be able to comprehend analyze the process of harmonisation of EU and Turkey's tax law

Programme Outcomes (Public Finance and Tax Applications Master's Without Thesis)

Prepared by Adnan Menderes University E-Campus Automation on: 19/10/2017

2/2