Uploaded by

common.user17545

Question

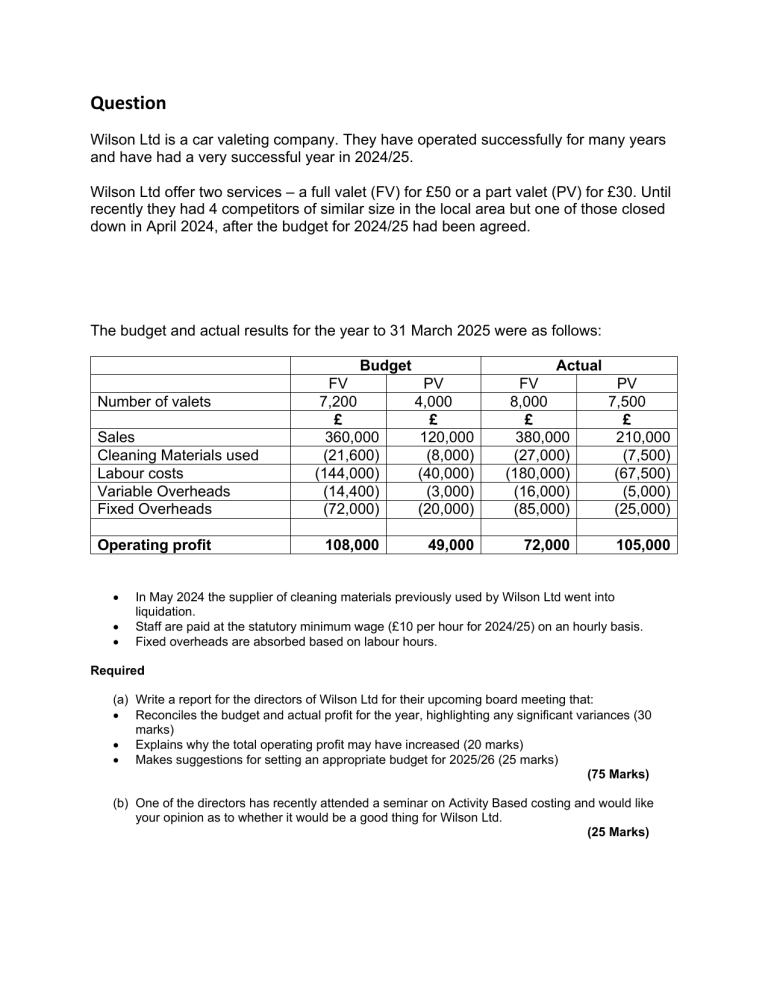

Question Wilson Ltd is a car valeting company. They have operated successfully for many years and have had a very successful year in 2024/25. Wilson Ltd offer two services – a full valet (FV) for £50 or a part valet (PV) for £30. Until recently they had 4 competitors of similar size in the local area but one of those closed down in April 2024, after the budget for 2024/25 had been agreed. The budget and actual results for the year to 31 March 2025 were as follows: Budget Actual Sales Cleaning Materials used Labour costs Variable Overheads Fixed Overheads FV 7,200 £ 360,000 (21,600) (144,000) (14,400) (72,000) PV 4,000 £ 120,000 (8,000) (40,000) (3,000) (20,000) FV 8,000 £ 380,000 (27,000) (180,000) (16,000) (85,000) PV 7,500 £ 210,000 (7,500) (67,500) (5,000) (25,000) Operating profit 108,000 49,000 72,000 105,000 Number of valets In May 2024 the supplier of cleaning materials previously used by Wilson Ltd went into liquidation. Staff are paid at the statutory minimum wage (£10 per hour for 2024/25) on an hourly basis. Fixed overheads are absorbed based on labour hours. Required (a) Write a report for the directors of Wilson Ltd for their upcoming board meeting that: Reconciles the budget and actual profit for the year, highlighting any significant variances (30 marks) Explains why the total operating profit may have increased (20 marks) Makes suggestions for setting an appropriate budget for 2025/26 (25 marks) (75 Marks) (b) One of the directors has recently attended a seminar on Activity Based costing and would like your opinion as to whether it would be a good thing for Wilson Ltd. (25 Marks)